- 30% growth in sales volume of specialty pulps during the first nine months of 2025 compared to the same period in 2024. These higher-margin products are expected to represent over 60% of total sales by 2028.

- Ence is developing the largest diversified renewable energy platform based on biomass in the Iberian Peninsula, transforming this raw material into regulated electricity, renewable industrial heat, biomethane, and renewable fuels.

- Launch of an Efficiency and Competitiveness Plan to be implemented between 2025 and 2027, based on two pillars: the deployment of Artificial Intelligence solutions, process reengineering and automation, and the rationalization of operational processes. This plan has an annual cash cost savings potential of approximately €22/t.

Ence has presented its results for the first nine months of the year, marked by the depreciation of the U.S. dollar against the euro and the decline in pulp prices, which reached lows of $1,000 per ton in the second half of August 2025.

The company reduced its operating costs by 30% in the Pulp business in the third quarter and continued advancing its transformation into a specialty pulp manufacturer — highly competitive in unit costs compared to long-fiber producers and a benchmark in revenue per ton compared to short-fiber producers.

Sales of specialty pulps, which have a €33 higher margin per ton than standard pulp, grew 30% in volume up to September and are expected to represent 62% of total sales by 2028, including the new 125,000-ton fluff pulp line, now operational and in the product certification phase.

With this new line, Ence has become the only European producer of short-fiber-based fluff pulp, used in the manufacture of absorbent hygiene products, and holds a unique competitive position versus long-fiber producers importing from the U.S. with higher costs and carbon footprints.

The company continues to make progress in developing its diversified biomass-based renewable energy platform. In the third quarter, within the renewable industrial heat business, construction began on two new projects with a combined estimated annual production of around 85 GWht/year, and a new operation and maintenance contract was signed for an existing plant with an estimated annual production of approximately 35 GWht. In the biomethane business, Ence’s project portfolio now includes 18 plants in advanced administrative processing and another 20 projects with completed location and feasibility studies, while renewable fuel projects continue their administrative procedures.

Recovery Outlook

Pulp prices bottomed out in August. Since then, global producers have announced price increases, which are already reflected in reference indices, showing improvements of $60/t over gross prices in Europe.

Additionally, the removal of U.S. import tariffs on pulp in September, together with scheduled maintenance shutdowns by major Latin American producers in Q4 2025 (approximately 0.5 million tons), should help consolidate this positive market trend.

Financial Results

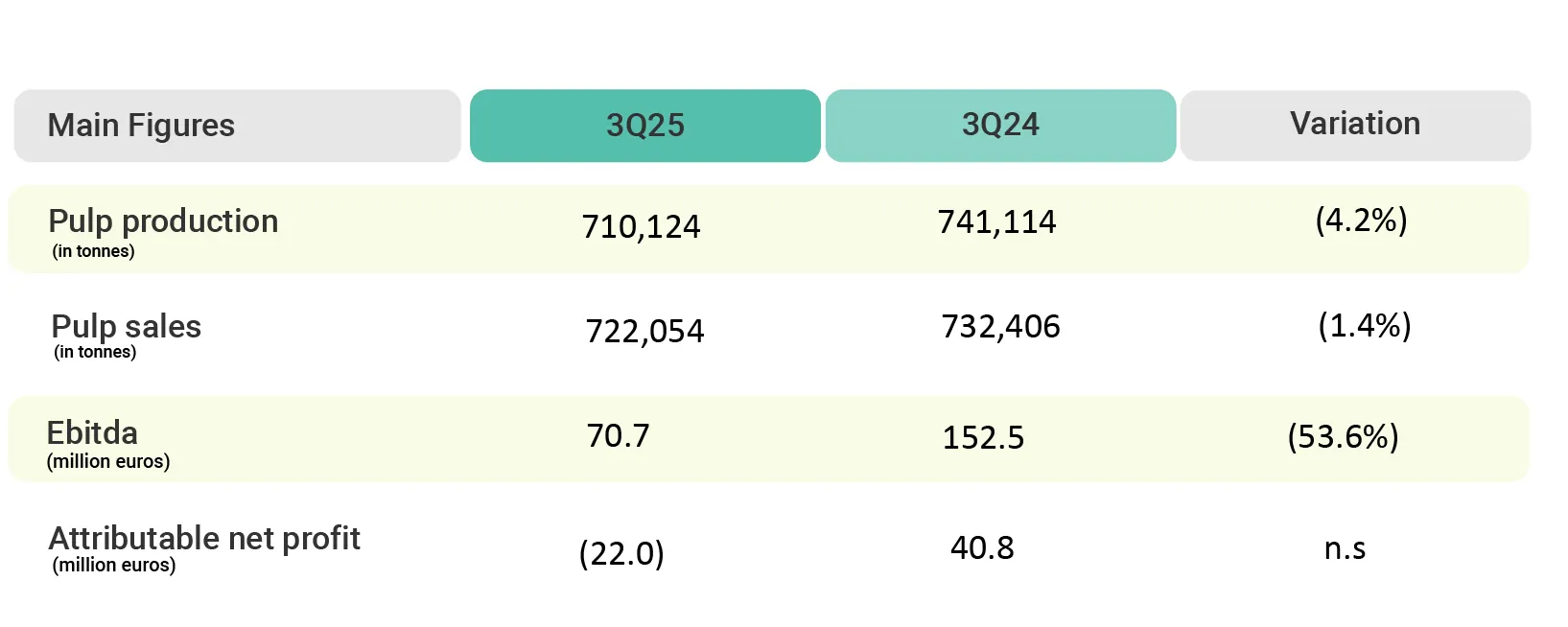

Up to September, the company recorded pulp sales volumes of 732,406 tons, 1.4% lower than in the same period of the previous year. However, third-quarter pulp sales were 13% higher than in the same quarter of 2024 and 8% higher than in the previous quarter, reflecting a reactivation of trade flows in the industry following the easing of tariff tensions.

In this context of declining pulp prices, Ence reduced its average cost per ton by €29/t in the quarter, down to €459/t. The company also launched an Efficiency and Competitiveness Plan to be implemented during 2025–2027, with an annual cash cost savings potential of approximately €22/t and an estimated cash outflow of €23 million over two years. This represents a Net Present Value (NPV) of approximately €200 million.

In the Renewables business, accumulated EBITDA through September was €18 million, compared to €21 million in the same period of 2024. The decline was due to lower production resulting from maintenance operations carried out during the year and subsequent ramp-ups. However, in the third quarter, EBITDA improved to €8 million, compared to €4 million in the previous quarter.

Free cash flow, before efficiency and growth investments, was positive at €12 million in the quarter, despite low pulp prices. Working capital variation contributed €18 million in cash inflows, mainly in the Pulp business, driven by lower inventories and receivables following the collection of €13 million in Energy Savings Certificates (including VAT) recorded in the previous quarter.

In the first nine months of 2025, the company reported a net attributable loss of €22 million, compared to a profit of €41 million in the same period of 2024.

Net financial debt as of the end of September stood at €367 million, with €264 million in cash — €256 million from the Pulp business and €111 million from Renewables.