- Speciality pulps will represent over 60% of Pulp sales by 2028, including 125,000 tonnes from the first fluff pulp line, which will start up in the fourth quarter of 2025.

- Reduction in cash cost. During the second quarter of 2025, the company reduced its average cash cost per tonne of pulp to €488, an improvement of €22/tonne compared to the previous quarter.

- Only European producer of short-fibre fluff. The new fluff line will enable Ence to become the only European producer of fluff pulp made from short fibre, replacing the more costly long-fibre alternative.

- Diversified renewable energy platform. The company is driving forward a biomethane platform targeting 1TWh of production and €60 million in EBITDA by 2030. In addition, in the renewable industrial heat segment, it aims to reach 2TWht/year of production and €40 million in EBITDA by 2030.

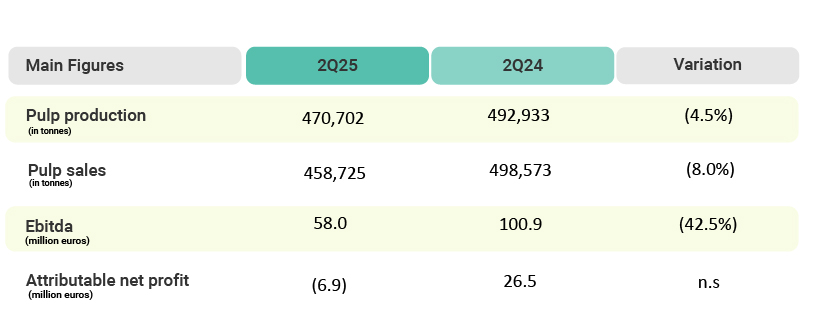

Ence has published its results for the first half of the year, marked by falling pulp prices and uncertainty stemming from tariffs.

During this period, the company has remained focused on its transformation strategy towards becoming a producer of higher-value speciality pulps that can replace long fibre, positioning it as one of the most competitive producers in that market. This is complemented by its commitment to unconventional renewable energy, through new developments in biomethane and renewable industrial heat.

In the second quarter of 2025, Ence succeeded in reducing its average cash cost per tonne of pulp to €488, an improvement of €22/tonne compared to the previous quarter, thanks to continuous improvements in operational efficiency and energy optimisation initiatives.

Ence’s fluff pulp to replace long fibre-based pulp

Speciality pulps continue to gain prominence in the company’s commercial mix, already accounting for 32% of total Pulp sales in the first half, up from 23% in the same period of 2024.

This evolution reflects Ence’s firm commitment to higher-value products and will be further bolstered in the fourth quarter of the year by the commissioning of a new fluff pulp production line for the absorbent hygiene product market. With this type of speciality pulp, Ence will become one of the most competitive producers in this market compared to long-fibre producers.

Financial results

Ence recorded revenues of €192 million in the second quarter, 3% more than in the previous quarter. This was driven by a higher volume of sales in both the Pulp business (243,000 tonnes, 12% more than in the previous quarter, which included the Navia mill shutdown) and the Energy business (303 GWh, 9% more than in the previous quarter), which helped offset a weak price environment.

Focusing on the first half of 2025, the Group finalised two sales transactions involving 191 million Energy Saving Certificates (CAEs) (equivalent to savings of 191 GWh) and 61 million CAEs (equivalent to 61 GWh), respectively. Their transfer price, net of acquisition costs, amounted to €30 million and €10 million, respectively.

In the first half of 2025, the company posted an attributable net result of -€6.9 million, impacted by the fall in pulp prices.

As for net financial debt at the end of June, it stood at €362.5 million (including €60 million in IFRS 16 liabilities), of which €256.0 million corresponded to the Pulp business and €106.5 million to the Renewables business.

Outlook

The average gross price of short-fibre pulp (BHKP) in Europe was $1,177/tonne between April and June (compared to a peak of $1,218/t in April), and in July it stands at $1,060/t — below the marginal cost of production for part of the industry. The restocking process is expected to drive a recovery in prices once tariff uncertainties have been resolved.