Financial information

Periodic Reporting

Find below the historical information, classified by year, related to our quarterly and half-yearly results: reports, presentations, results conference call, results call announcement, results in Excel format, results presentation video, Sustainability Reports and six-monthly consolidated accounts.

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

*The official document is the one prepared in the ESEF format.

**xHTML – ZIP: European Single Electronic Format (ESEF).

Key figures

ENCE’s key operating and financial indicators for the last 10 years:

- Pulp sales (t)

967.628

-1,1% - Group revenue (Mn €)

876,2

5,6% - Net Profit (Mn €)*

31,6

n.s. - Cash Cost in the Pulp Business (€/t)

493

-6,2% - Group EBITDA (Mn €)

164,5

85,2% - Earnings per share (€/acc.)

0,13

n.s. - Renewable Energy sales (MWh)

1.167.089

23,2% - Group EBIT (Mn €)

63,3

n.s. - Group Net Debt (Mn €)

321,2

14,8%

- Pulp sales (t)

978.501

18,4% - Group revenue (Mn €)

830,1

-17,27% - Net Profit (Mn €)*

-26,2

n.s. - Cash Cost in the Pulp Business (€/t)

526

-4,90% - Group EBITDA (Mn €)

89,3

-63,93% - Earnings per share (€/acc.)

-0,1

n.s. - Renewable Energy sales (MWh)

947.249

-36,10% - Group EBIT (Mn €)

-2

n.s. - Group Net Debt (Mn €)

279,6

n.s.

- Pulp sales (t)

826.617

-17% - Group revenue (€ Mn)

1.003,4

-22,4% - Net Profit (€ Mn)*

247,2

n.s. - Cash Cost in the Pulp Business (€/t)

553

41,0% - Group EBITDA (€ Mn)

247,6

-131,7% - Earnings per share (€/share)

1,02

n.s. - Renewable Energy sales (MWh)

1.481.446

3,6% - Group EBIT (€ Mn)*

278,2

n.s. - Group Net Debt (€ Mn)

-30

n.s

*Includes reversal of impairments and provisions related to the Pontevedra biofactory.

- Pulp sales (t)

996.058

-1,9% - Group revenue (€ Mn)

819,7

-15,8% - Net Profit (€ Mn)

-190,4

n.s. - Cash Cost in the Pulp Business (€/t)

392

+4,8% - Group EBITDA (€ Mn)

106,8

+45,1% - Earnings per share (€/share)

-0,78

n.s. - Renewable Energy sales (MWh)

1.430.199

+0,6% - Group EBIT (€ Mn)

-175,9

n.s. - Group Net Debt (€ Mn)

101,8

-42,8%

- Pulp sales (t)

1.015.482

+11,5% - Group revenue (€ Mn)

707,7

-3,8% - Net Profit (€ Mn)

-26,4

n.s. - Cash Cost in the Pulp Business (€/t)

374

-5,7% - Group EBITDA (€ Mn)

73,6

-42,0% - Earnings per share (€/share)

-0,11

n.s. - Renewable Energy sales (MWh)

1.421.446

+35,7% - Group EBIT (€ Mn)

-40,1

n.s. - Group Net Debt (€ Mn)

168,6

-67,12%

- Pulp sales (t)

910,499

-3.9% - Group revenue (€ Mn)

735.4

-11.6% - Net Profit (€ Mn)

9.2

-92.9% - Cash Cost in the Pulp Business (€/t)

397

5,2% - Group EBITDA (€ Mn)

127.0

-56.3% - Earnings per share (€/share)

0.04

-92.9% - Renewable Energy sales (MWh)

1,047,163

13.3% - Group EBIT (€ Mn)

32.5

-84.5% - Group Net Debt (€ Mn)

512.7

68.2%

- Pulp sales (t)

947.466

-2,9% - Group revenue (Millions €)

832,0

12,4% - Net Profit (Millions €)

129,1

40,7% - Cash Cost in the Pulp Business (€/t)

377

7,8% - Group EBITDA (Millions €)

290,9

34,7% - Earnings per share (€/share)

0,5

40,7% - Power sales (MWh)

923.935

4,5% - Group EBIT (Millions €)

209,6

40,1% - Net Debt (Millions €)

304,8

99,1%

- Pulp sales (t)

975.302

5,6% - Group revenue (Millions €)

740,3

22,3% - Net Profit (Millions €)

91,8

138,6% - Cash Cost in the Pulp Business (€/t)

350

-2,0% - Group EBITDA (Millions €)

216,0

72% - Earnings per share (€/share)

0,4

142,4% - Power sales (MWh)

884.149

40,7% - Group EBIT (Millions €)

149,6

105,8% - Net Debt (Millions €)

153,1

-29,9%

- Pulp sales (t)

923.408

4,3% - Group revenue (Millions €)

605,4

-8,8% - Net Profit (Millions €)

38,5

-22,8% - Cash Cost in the Pulp Business (€/t)

357

-0,6% - Group EBITDA (Millions €)

125,6

-34,5% - Earnings per share (€/share)

0,2

-24,1% - Power sales (MWh)

628.386

2,1% - Group EBIT (Millions €)

72,7

-45,4% - Net Debt (Millions €)

218,3

-9,5%

- Pulp sales (t)

885.280

-22,1% - Group revenue (Millions €)

663,9

-3,4% - Net Profit (Millions €)

49,9

135,4% - Cash Cost in the Pulp Business (€/t)

359

-11,6% - Group EBITDA (Millions €)

191,8

337,9% - Earnings per share (€/share)

0,2

-63,8% - Power sales (MWh)

615.397

35,7% - Group EBIT (Millions €)

133,2

324,6% - Net Debt (Millions €)

241,2

-15,2%

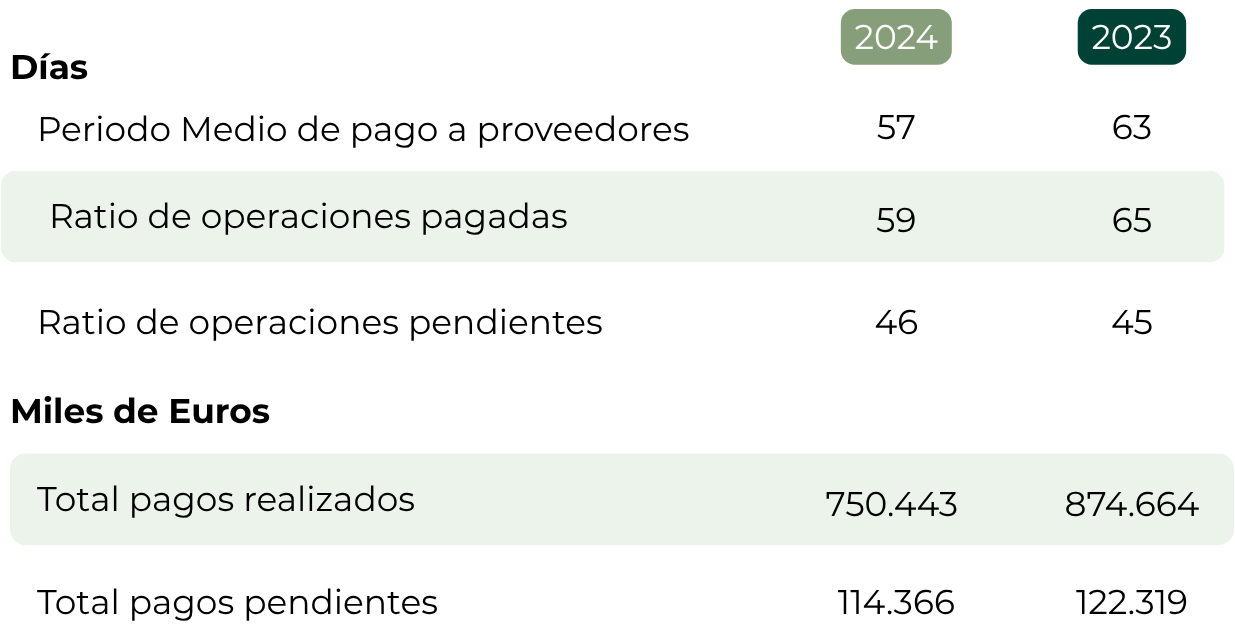

Average supplier payment term

The information on the average payment period has been prepared in accordance with Law 15/2010, which establishes measures to combat late payment in commercial transactions, the amendments established in Law 18/2022 of 28 September on the creation and growth of companies, and the second final provision of Law 31/2014 of 3 December, which has been prepared in accordance with the Resolution of the Institute of Accounting and Auditing dated 29 January 2016.

The average payment period is as follows:

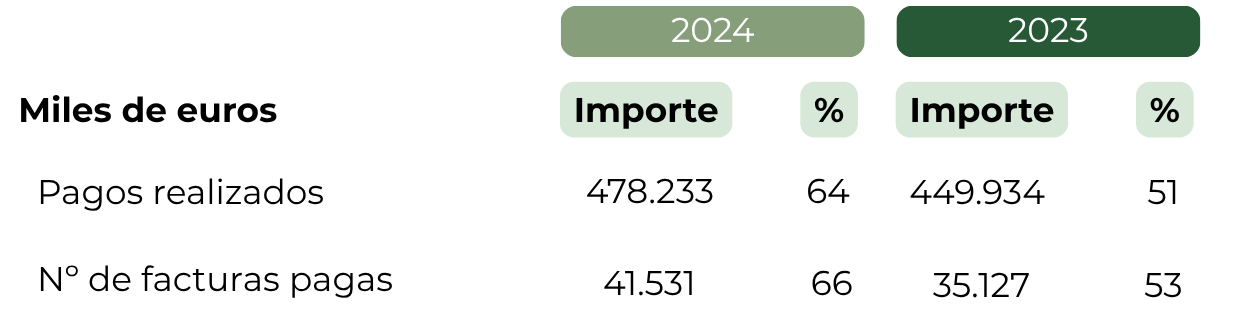

The following is a breakdown of invoices paid within a period shorter than the maximum established in the regulations on late payment:

The specifications used to prepare this information are as follows:‘Average payment period to suppliers’ shall be understood to mean the period from the delivery of goods or provision of services by the supplier to the payment of the transaction. This period is calculated as the quotient formed in the numerator by the sum of the ratio of transactions paid by the total amount of payments made plus the ratio of transactions pending payment by the total amount of payments pending and, in the denominator, by the total amount of payments made and payments pending.Ratio of transactions paid: amount in days resulting from the quotient between the sum of the products of the amount of each of the transactions paid by the number of days of payment and the total amount of payments made during the financial year.

Ratio of transactions pending payment: amount in days resulting from the quotient between the sum of the products of the amount of the transaction pending payment by the number of days pending payment and the total amount of payments pending.

Payment obligations that have been subject to withholding, balances with public bodies, and direct debit payments are excluded from the scope of the information.