Ence in the stock market

Share price

ENCE’s shares are listed on the Spanish stock exchange and the continuous market since it was fully privatised in 2001. They are traded in the Ibex Medium Cap index. ENCE’s stock codes on Bloomberg and Reuters are ENC.SM and ENC.MC, respectively.

Capital

The Company’s share capital comprises 246,272,500 shares with a par value of € 0.90 each. The Company’s shares are represented by the book-entry method, and all have the same voting and dividend rights.

1. Trend in share capital

2. Changes in share capital

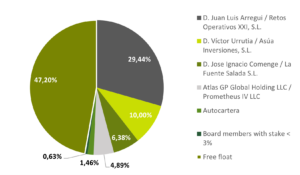

Shareholding structure

Shareholder distribution as of December 2024 according to information sent to the CNMV, as well as the links to the section on significant holdings and treasury stock of the CNMV.

Significant Holdings and Own Shares (CNMV)

Dividends

1. Dividend Policy

Below are the key characteristics of the dividend policy in effect since 2022:

Shareholder remuneration in each year will be determined by the cash available for distribution while ensuring an appropriate level of leverage of, by way of reference, 2.5 times EBITDA in the Pulp business and 5 times EBITDA in the Energy business, using mid-cycle prices and considering existing commitments and investment plans

In keeping with the criterion of prudence and in order to align remuneration with the Company’s actual cash generation, the following dividend payment schedule is proposed:

- Two interim dividends agreed at the end of the second and third quarters of each year, i.e., in the months of July and October

- A final dividend for submission at the Company’s Annual General Meeting within the first six months of the following year

2. Historical

The table below itemizes the dividends paid out by the Company in the last 10 years: